When asked what is the major problem faced in an organization, most of the employers have a common answer. It is employee retention.

Retaining good and talented employees is one of the major goal of a business.

But why do people leave and how do we reduce employee turnover?

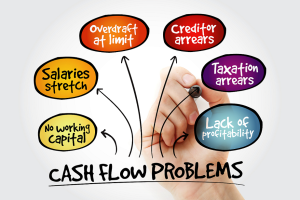

There is no denying that today’s market is a tough one and there is competition all around. There is a severe shortage of cash flow resulting in cash flow related problems in a business. Since there is fragmented cash flow there is a shortage of cash to invest in business growth. You might be delayed in paying the vendors or might not be able to stock up on inventories like you wanted to.

Even your receivables might be disturbed and client payments might not run as expected. All this leads to shortage of fund in the organization. This is the time when most employers are faced with an unwanted dilemma on if they should postpone or cancel their employee’s salaries.

Many business owners decide to post pone their staff’s salaries by a month or two month and some for even a longer period. Delay or postponement in payrolls can lead to various repercussions.

It can harm employee morale and lead to low employee satisfaction. Your employees trust in you will be questioned and their motivation to work hard will go low. It has been proven that when employee morale is low it leads to drastic reduction in productivity at work.

When the productivity of the workers goes down, it will have a huge impact on your business and the profits. Not only this but when employees don’t trust you to pay them on time, they are most likely to look for employment opportunity elsewhere. This increases employee turnover which will give your organization a bad name in the market.

So how can you help your employee benefit and improve employee retention?

There are two solutions to this.

One is Payroll Financing. With the help of payroll financing you can take help from a lender to process payrolls for your employees wherein you get a line of credit that you can use to pay salaries to your employees.

1 Click Payroll is the perfect product when looking for unsecured payroll financing. It is low cost and quick solution to make sure that you don’t miss even one month without paying salaries to your employees.

The second solution is salary advance. By providing your employees the benefit of drawing an advance salary you give them a choice of drawing a contingency salary when they are in need.

This will improve your employee morale and their trust in you. This leads to higher employee retention as the staff will want to stay loyal to you as you are to them. Happy employees always lead to happy clients.

1 Click Salary Advance will help you provide your employees the opportunity of drawing an early salary if and when they need urgent cash and pay day is not near. 1 Click Salary advance is a short term loan, which grants employees 24×7 access to liquidity. They don’t need to wait till the end of the month for their salaries.

When you put your employee’s benefits first and give them priority over other things, they will in return work hard and with dignity for you. So providing them salary each month on time as well as early salary should be a goal of all employers to keep their employees happy and satisfied.

Hi, Want to learn more about Payroll financing

Regards

Bhaskar V