Running a small business can come with its own set of challenges. Handling company’s cash flow while maintaining the business, the purchases and sales, the inventory, looking after the employees and maintaining equipment can be really tough. Cash flow issues are face by about 60 % of small business owners.

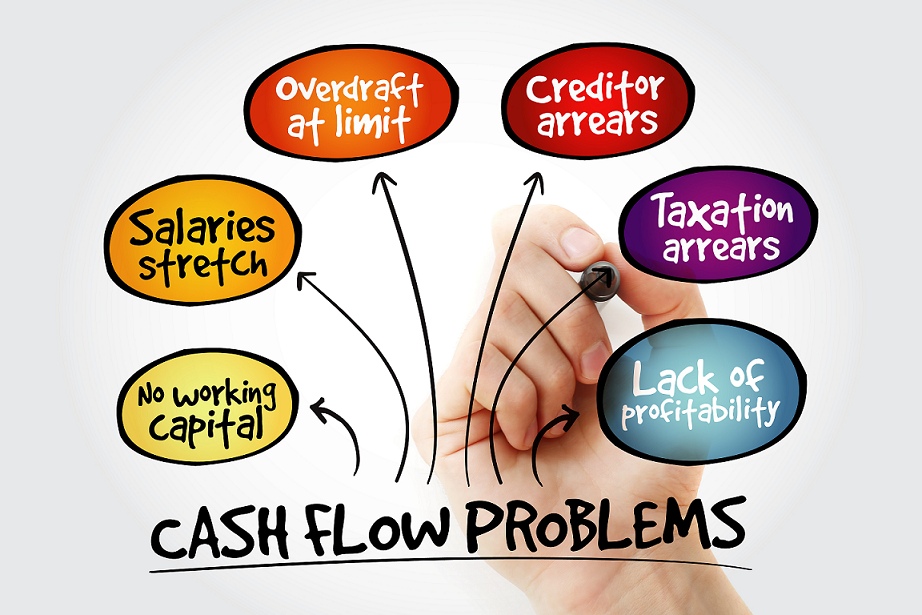

Here are some of the reasons behind cash flow issues for small businesses.

- Waiting for outstanding receivables

Receivables is the balance of cash/money that is due to an organization. Supposing a company has provided certain services or delivered products to a client or customer but the client is yet to pay their dues and owns the business the payment for said services. So the company will now have outstanding receivables pending until the client pays in full. Most small business owners have outstanding receivables waiting to be paid.

- Unforeseen Expenditures

Many times small businesses can face an emergency out of the blue expenditure which can shake up their whole planning for their cash in and out flow. There can be an equipment that breaks or some accident that occurs or unseen tax payment that lines up. It’s always important to anticipate such emergencies and plan for them in your budgeting. But most of the time these expenses are unexpected. Make a plan to minimize the damage cause by the emergency and plan for such future expenditure so cash flow is not severely impacted again.

- Clearance of customers payments

Managing payments is not easy for everyone. Business owners will issue invoices that charge clients or consumers for operations on a fixed date. On the other hand small business owners accept advance payments. This enables business owners to charge or clients for services either before or shortly after they are rendered. Processing of money after receiving payments is one of the biggest reasons behind a company’s cash flow issues. Almost one third of entrepreneurs’ complaint that they wait around 30 days for their payments.

- Running employee’s payroll time

One of the major area that gets impacted with cash flow hindrance is running payroll for employees. It’s not just the business that gets affected but also the staff’s timely salaries get impacted when cash flow is tight. 43 % of business owners have faced an issue where they couldn’t pay their employees on time due to cash flow issues. The consequences of running late payrolls can be detrimental. Many employees who work for small business owners live from pay check to pay check. So when they are not able to get their pay checks on time their retention is in jeopardy.

- Making Liquid Capital Available for Business

There comes a time when it is too difficult to manage to have liquid capital for small business owners. Many business owners have to turn to taking out loans or get help from other lending services. Many business owners feel like applying for loans is a sign of failure. When applying for traditional loans collaterals can be a tricky thing and even the interest rates are too high for small businesses to pay back. In such cases small business owners should turn to payroll funding which can bring in capital for them to pay their employees on time while focusing the existing capital on business development. 1 Click Payroll can help businesses with short term unsecured funding till they are strong enough to stand up on their feet.

To help resolve these issues, business owners can talk to an accountant or a financial advisor. Experts in their field can help entrepreneurs get back on track by implementing better billing procedures that can benefit small enterprises. Companies and their owners will be able to maintain connections with employees, vendors, clients, and customers once they are better prepared to address these problems. They can also look into payroll financing which can greatly help with paying the employee’s salaries and focusing the company’s capital on business expansion. Running a small business is no easy feat but with a few carefully planned systems in place it can be quite a rewarding experience