Getting a loan approved is difficult, even you may have done extensive research to locate a lender that will give you the best deal. There are no assurances that your loan will get approved no matter the research as there can be various reasons that your loan approval can get rejected.

Here are some of the reasons why your loan application might be getting rejected.

- Yearly Income and Debt

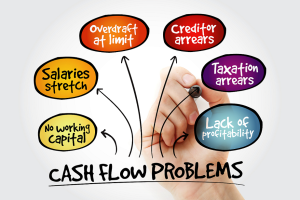

Lenders usually check your annual income as well as your current debt situation while approving your loan application. This helps them to establish if you are in the position to pay back the capital amount that you wish to be granted. If the lending agency feels that your yearly income isn’t enough for you to be able to pay back the loan your application will likely be rejected. Also if you have any pending debts to be paid, it is a red flag as well, so it is advisable to pay your pending debts before you apply for a loan.

2. Impending Loans from the Past

Bank and lending agencies can access your financial history and see if you have availed loans from any banks or third party. This is why it is advised that one should only take loans when necessary and make sure that you pay the installments on time. This is why it is another reason your loan application might get rejected if you have ongoing loans that are unpaid from the pas

3. Signature that Doesn’t Match Yours

This might not happen often but it does happen. Getting the perfect signature every time might be tricky for some people. Since getting a loan is a hectic process, when your signature doesn’t match your loan application ends up getting rejected. This is why you must try that you have a perfect signature on all your documents so your application doesn’t get rejected.

4. Low CIBIL Score

One of the most important aspect when it comes to loans is your CIBIL score. Banks and lending agencies consider your CIBIL score to validate your application. This credit score is dependent on how you manage your credit. . In India, CIBIL is one of the respected firms that provides credit score data to lenders. You are more likely to have a strong credit score that will allow you to qualify for loans if you have kept up a solid credit utilization ratio and a history of on-time payments. However, those that don’t do this have lower credit scores, which results in their loan application being denied.

5. Inaccurate or Incomplete Loan Application

The information provided on the loan application like your name, phone number, account details, residence address etc. play an important role. It will be used to get the needed information about you. They are used to check your credibility. Loan applications get rejected due to a document that was not attached or some important information that was mandatory that was left out. This is why it is absolutely necessary to properly fill out all the details on your application and also to provide all the necessary documents

6. Negative credit report

Although people say that you can build your credit scare in 24 months, events like foreclosure or bankruptcy will negatively impact your application.

7. Unstable Residential Address

Sometimes banks reject your application if they can’t verify your residential stability. Your documents that you submit for KYC should take care of your residential address. Of you live on rent you might need to give some additional details in your application.

8. Eligibility Not Approved

There are certain criteria for you to be eligible for personal loans like age, your education qualification, your nationality etc. Banks will make sure to check each and every credential before approving your loan application

9. Job Stability

If you are frequently switching from job to job there are chances that your loan application will get rejected because financial stability is very much valued when it comes to loan approvals

Now that you know what are the reasons behind loan application being rejected make sure you don’t commit these mistakes while applying for a personal loan or business loan.