Introduction

Credit bureaus are organizations that collect and store information about your credit history. This includes things such as loans, mortgages and other types of debt. It’s important to know about them because they can affect your ability to get financial services such as a loan or mortgage.

What is a Credit Bureau?

A credit bureau is a company that collects information about you and your financial history. It then sells this data to lenders, who use it to make decisions about whether or not they’ll lend you money. Credit bureaus have been around since the early 1900s, but they weren’t always as big or powerful as they are today. Today’s credit bureaus collect information from banks and other lenders, as well as public records such as court filings and tax returns. They sell this information to companies looking for new clients (i.e., potential borrowers). Let’s find out which credit bureau is most used in India?

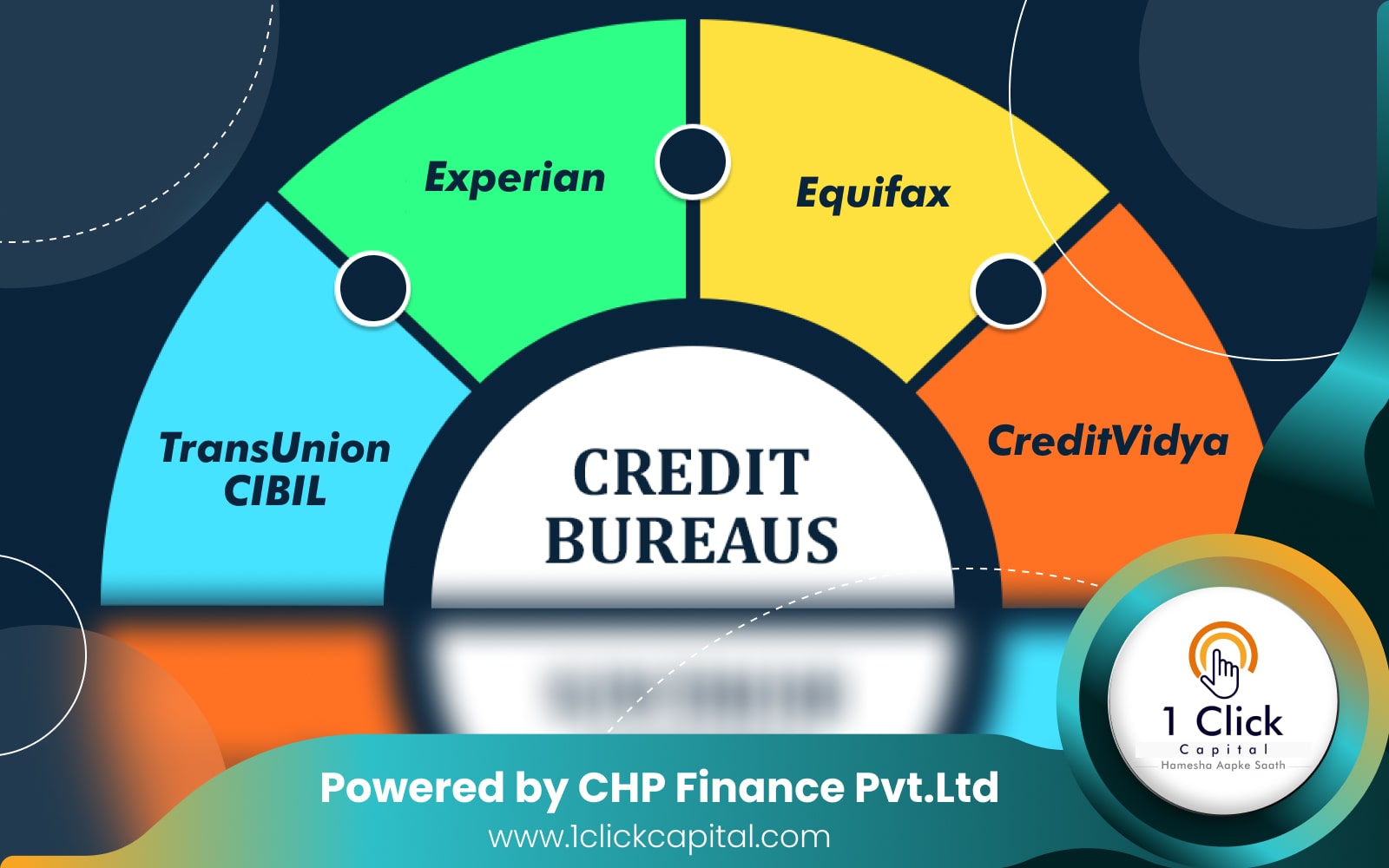

Top 4 Credit Bureaus in India

- TransUnion CIBIL

- Experian

- Equifax

- CreditVidya

How to Access Your Credit Report

There are several ways to access your credit report. If you’re looking for a free option, then the best way is through Credit Information Bureau (India). You can order a copy of your CIBIL report by calling their toll-free number or visiting their website. Once you have ordered and received your report, it is important that you understand how to read it. A good way to do this is by comparing multiple reports from different bureaus so that they can give an accurate picture of what’s going on with your finances overall.

How to Improve Your Credit Score

The best way to improve your credit score is by paying all of your bills on time and keeping balances low. It’s also important to avoid opening new lines of credit if you can help it, as this can negatively impact your score.

Here are some tips for maintaining a good credit score:

Tips for Avoiding Credit Fraud

- If you’ve been a victim of credit fraud, it’s important to act quickly. The sooner you report the crime, the more likely it is that law enforcement officials will be able to track down the perpetrator and recover your money.

- If someone uses your identity for financial gain (e.g., opening new accounts) or to avoid paying debts they owe, contact both local police departments and federal agencies immediately.

What to Do if You Disagree with a Credit Report

If you disagree with a credit report, contact the credit bureau and ask them to investigate. You can do this by phone or mail (the address is on the back of your credit report). You should also send any supporting documents such as receipts for payments made or copies of written correspondence related to an account in dispute. If you don’t get a response from the credit bureau within 30 days, write again asking for an update on their investigation into your dispute. If they still don’t respond within 60 days after that second request, call them again and ask why they haven’t responded yet–and then keep calling every 30 days until it gets resolved!

Conclusion

The credit bureaus are a powerful tool to help you get the most out of your financial life. They can help you find the best deals on loans, credit cards and insurance, as well as alerting you to any suspicious activity in your accounts. Credit reports are an important part of understanding how these companies work so that you can use them to your advantage!