Are you struggling to make ends meet? Trying to manage your monthly expenses and still get ahead? Many individuals in the same situation feel stuck. But what if there was a way to jumpstart your financial freedom? That’s where an advance salary comes in.

An advance salary is exactly what it sounds like: a one-time loan or payment that you receive before payday, giving you access to funds that you normally wouldn’t have access to until your next paycheck. It can provide much-needed leeway and cushion between bills and income. In this article, we’ll explore why an advance salary can be a great tool for employees looking for a quick solution to their financial struggles.

What Is an Advance Salary?

Have you ever wished that you could have your salary in advance? An advance salary can make that wish come true.

An advance salary is a type of loan that lets employees access a portion of their wages before their payday. This provides employees with a source of emergency funds when they need it most, allowing them to pay for unexpected bills and expenses without having to worry about debt or incurring late payment fees.

Having an early salary can help employees achieve greater financial freedom and stability. Not only can it provide them with immediate access to funds during times of financial need, but it can also give them a much-needed boost in times when their regular salary may not be enough.

Benefits of 1 Click Salary Advance

An instant salary advance loan can help you meet your financial needs in a few ways. First, it’s flexible. An advance salary allows you to choose how much you need and when you need it.

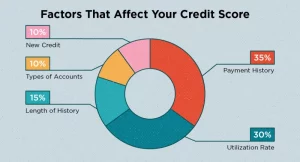

Second, it’s available quickly—often within hours of applying for one. And third, an advance salary helps you build your credit score with timely payments that are reported to the credit bureau.

Besides being convenient and fast, here are other ways an advance salary can help employees reach financial freedom:

- It allows access to immediate cash flow, helping avoid overdraft fees or other high-interest debt.

- It’s reliable since there’s no requirement to apply again and again for an advance salary; once approved, the requested funds will be available at any time during your employment period.

- It’s hassle-free since there’s no paperwork or lengthy application process involved.

- Most of all, it helps employees better manage their finances by providing a reliable source of capital to bridge financial gaps or tackle unexpected expenses.

Tips to Choosing the Right Lender

When considering if you should get an advance salary, it’s important to ensure that you’re getting it from a reputable lender. There are many lenders out there that offer this service and some may not have the same standards as others. Factors like fees, interest rates, repayment terms and customer service should all be taken into consideration when finding the right lender for you.

When looking for a lender for advance salary, there are few things that you should keep in mind:

1. Do your research – Look around and make sure that the lender is reputable, able to provide what they promise and have clear terms and conditions.

2. Check reviews – Read reviews of the lender from customers who have used its services before to get an idea of the quality of services provided by the company.

3. Compare offers – Get quotes from multiple lenders so you can compare their offers and decide which one best suits your needs.

4. Read T&Cs carefully – This is essential when taking out any loan or credit product, make sure to read through every detail of the T&Cs so that you know exactly what’s expected of you during repayment period

By doing due diligence upfront and going through reputable lenders like 1 Click Capital, getting an advance salary can be a great way to help employees reach financial freedom quicker than they would if they had no access to this type of service.

In summary, an advance salary can be a valuable financial tool for employees. It can provide an immediate relief from potential financial emergencies as well as provide assurance from having to dip into savings or taking out loans with unfavorable interest rates.